Release Date : 2025-12-08

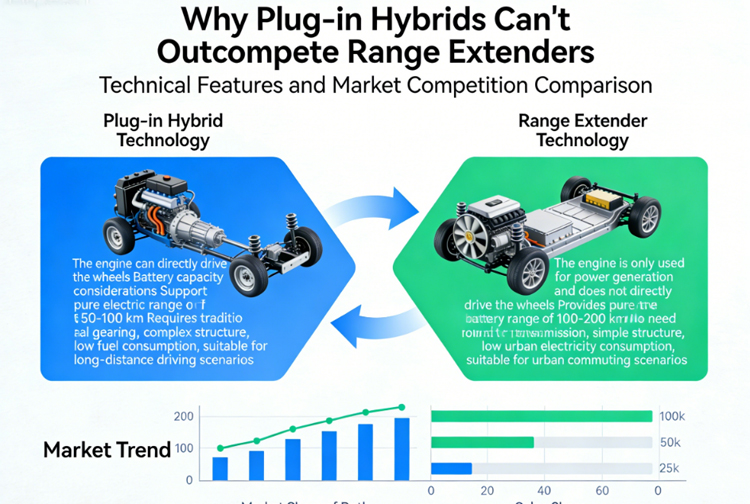

Despite the fact that plug-in hybrid (PHEV) technology offers advanced features, it has yet to completely dominate the market, especially in comparison to extended-range electric vehicles (EREVs). The key reason lies in how well these technologies adapt to user needs and real-world driving scenarios. In this article, we explore the fundamental differences between PHEVs and EREVs, analyze the consumer market, and examine the factors that are shaping the future of these technologies.

Technological Differences: PHEVs vs. EREVs

From a technological standpoint, PHEVs and EREVs differ fundamentally in terms of their architecture and how they operate. PHEVs typically use a serial-parallel hybrid system, which allows the engine to directly drive the wheels, with advanced systems like BYD’s DM-i achieving an impressive high-speed direct-drive efficiency of 97%. These vehicles offer low fuel consumption, with models like the BYD Tang DM-i achieving a fuel consumption of only 4.34L/100km when running on gasoline.

On the other hand, EREVs, which employ a series hybrid structure, rely on an engine that functions solely as a generator to charge the battery, while the wheels are driven purely by an electric motor. A good example is the Li Auto L7, whose range-extender achieves a power generation efficiency of 3.2 kWh/L. The motor’s sole responsibility to drive the wheels ensures smooth, uninterrupted driving performance.

Market Dynamics: PHEV vs. EREV Sales

In terms of sales, the first three quarters of 2025 revealed interesting insights about the market share of these two technologies in China. PHEVs sold 2.395 million units, marking an 11.7% increase year-on-year, while EREVs saw sales of 843,000 units, growing by 4%. While PHEV sales are higher due to a larger base, EREVs have carved out a significant niche in certain markets.

One notable factor is that EREVs are particularly well-suited for the urban household context. Their electric-only range typically falls between 150 to 350 km, with models like the

Li Auto L7 offering an electric range of 212 km, which is more than sufficient for 95% of city commuting needs. This makes them an ideal choice for consumers who have access to home charging. Moreover, their lack of a traditional gearbox results in fewer moving parts, reducing the likelihood of mechanical failures. In fact, for users with a home charging station, annual electricity costs can be as low as ¥1500, putting EREVs on par with pure electric vehicles in terms of operational costs.

PHEVs: Strengths and Weaknesses

While PHEVs have their advantages in long-distance, high-speed driving scenarios, they still face challenges. For instance, the BYD Tang DM-i offers excellent fuel economy on highways, with a highway fuel consumption of 5.5L/100km, 2.5L lower than that of the Li Auto L8. However, PHEVs have more complex mechanical systems, leading to higher annual maintenance costs of around ¥3000, significantly higher than the ¥1500 required for EREVs. Additionally, some PHEV models experience issues with powertrain switching between electric and gasoline power, leading to noticeable jerks and a compromised driving experience.

The Role of Automakers and the Future of EREVs

Automakers are also contributing to the growth of EREVs. Companies like

ZEEKR and

Avatr, which initially focused on pure electric vehicles, are now launching range-extender versions of their models to cater to specific market needs. The HaoPo HL Range-Extended Version, for instance, offers a 350 km electric-only range, and it supports 5C fast charging, providing an impressive 210 km charge in just 10 minutes. This is a direct response to the issue of charging anxiety, addressing consumer concerns about long charging times and driving range limitations.

Policy Influence: Incentives and Green Plate Advantages

On the policy side, PHEVs enjoyed purchase tax incentives and other subsidies that made them an attractive choice in the past. However, EREVs have managed to retain some of their competitive edge by offering a long enough electric-only range to qualify for green license plates in certain cities. These green plates offer access to restricted areas, making EREVs particularly attractive in urban centers with traffic restrictions. Additionally, the simpler architecture of EREVs means that they are easier for manufacturers to develop, helping lower the R&D threshold for automakers.

Conclusion: A Market of Adaptation

In conclusion, both PHEVs and EREVs have their respective advantages, but the user’s needs and driving scenarios play a significant role in shaping which technology will dominate in the coming years. EREVs, with their simplicity and reliability, are particularly well-suited to urban environments, while PHEVs excel in long-distance travel. The ability to cater to specific use cases, combined with evolving policies and automaker strategies, will determine how these two technologies evolve in the market.

.jpg)

.jpg)